iowa property tax calculator

Annual property tax amount. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents.

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

The property tax estimator assumes that property taxes are paid on September 1st and March 1st.

. Fields notated with are required. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on household income for claimants aged 70 years or older. Get Involved - Volunteer.

Property taxes are not determined by a single individual who assesses your property and sends you a bill. This Calculation is based on 160 per thousand and the first 500 is exempt. This Property Tax Calculator is for informational use only and may not properly indicate actual taxes owed.

For comparison the median home value in Iowa is 12200000. To view the Revenue Tax Calculator click here. So if you pay 2000 in Iowa state taxes and your school district surtax is 10 you have to pay another 200.

Effective August 16 October 31 2022. Iowa Tax Proration Calculator Todays date. The tax is imposed on the total amount paid for the property.

- Dallas County Iowa Courthouse 801 Court Street Rm 203 PO Box 38 Adel IA 50003 Phone. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Full or partial payments of current and delinquent taxes will be accepted at any.

Iowa property taxes are paid in arrears. Property tax proration. Find All The Record Information You Need Here.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The final tax rate is the result of budgets established to provide services an assessors assessment a county auditors calculations and laws administered by the Iowa Department of. For assistance call the Scott County Treasurer at 563-326-8664.

This calculation is based on 160 per thousand and the first 50000 is exempt. Property taxes may be paid in semi-annual installments due September and March. Credits and exemptions are applied only to annual gross net taxes total.

Unsure Of The Value Of Your Property. For comparison the median home value in Dubuque County is 13680000. The example above was a Polk County parcel and the tax levy rates by taxing district for Polk County can be found at Polk County Tax Levies.

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property.

This calculation is based on 160 per thousand and the first 500 is exempt. Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

In 2021 the Iowa legislature passed SF 619. Check the chart below for the surtax rates for Iowa school districts. To further complicate matters youre actually paying the last fiscal years property taxes.

That means that when paying property taxes in a given year youre paying last years taxes. Ad Find Iowa County Online Property Taxes Info From 2022. The median property tax in Iowa is 156900 per year for a home worth the median value of 12200000.

1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Dubuque County Tax. In other words claimants aged 70 years or older with higher household income are able to qualify for the property tax credit in 2022 and.

You may calculate real estate transfer tax by entering the total amount paid for the property. 2 Tax levy is per thousand dollars of value and varies with each taxing district. Counties in Iowa collect an average of 129 of a propertys assesed fair market value as property tax per year.

Iowa County Iowa - Real Estate Transfer Tax Calculator. Annual property tax amount. The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first September or second March payment period.

Iowa Tax Proration Calculator. Other credits or exemptions may apply. What is Transfer Tax.

Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Iowa is ranked number twenty eight out of the fifty states in order of the average amount of property taxes collected.

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

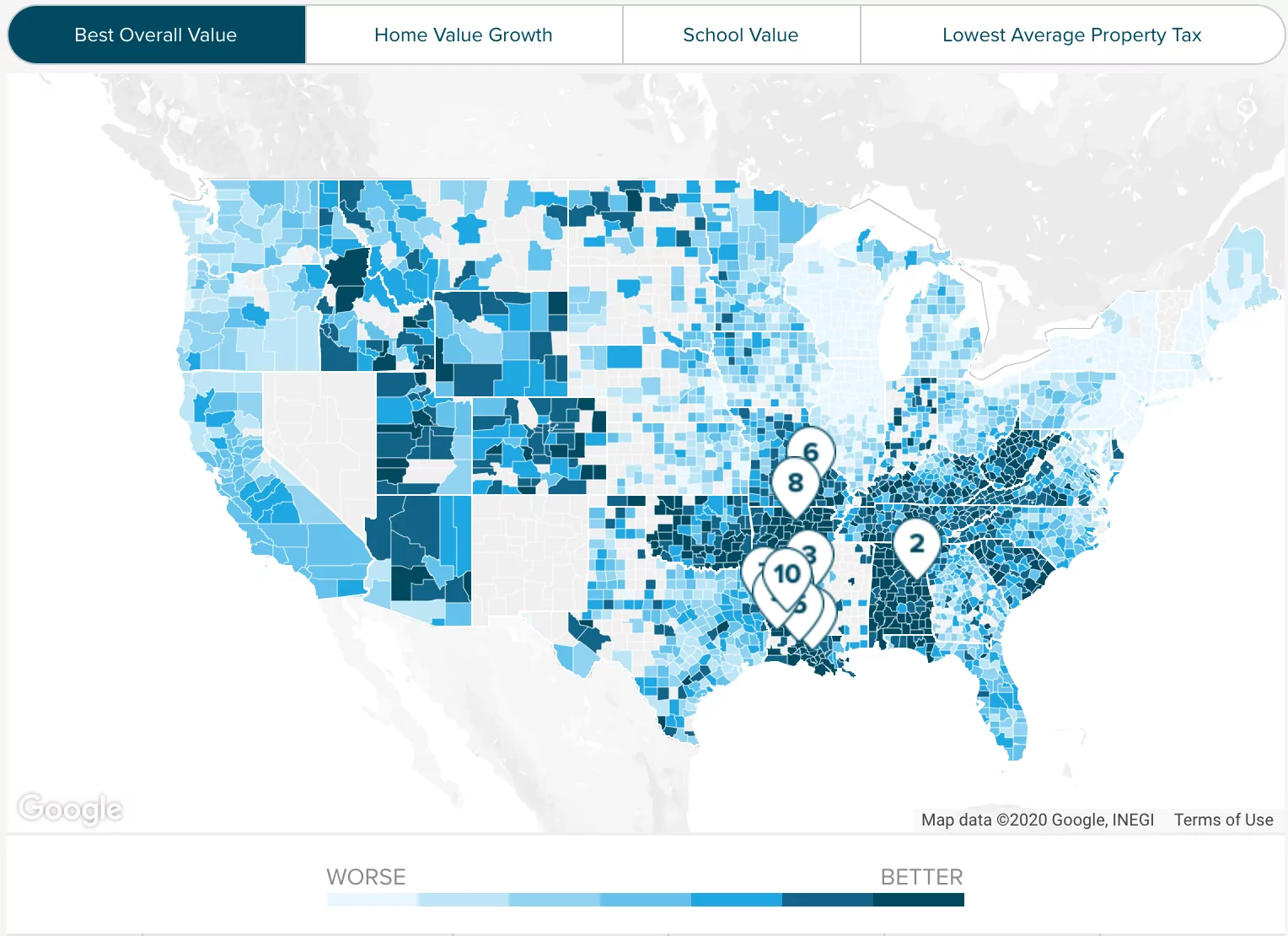

Property Taxes Property Tax Analysis Tax Foundation

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Property Taxes Property Tax Analysis Tax Foundation

2022 Property Taxes By State Report Propertyshark

Property Taxes On Owner Occupied Housing By State Tax Foundation Infographic Map Real Estate Infographic Map

Don T Navigate The Home Selling Process By Yourself Call Me To Get The Help You Need Jeanette Thedifferenceisinthedetails How To Find Out Call Me Helpful

Property Taxes Property Tax Analysis Tax Foundation

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Sold In 2022 Getting Things Done Country House Rocklin

King County Wa Property Tax Calculator Smartasset

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Financial Advisors Property Tax

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Property

How To Calculate Property Tax Everything You Need To Know New Venture Escrow